The current economic climate and its continuous and unpredictable effects on mortgages rates, rental prices and greater demand for financial access to loans and credit has propelled concerns over spikes in application and opportunistic fraud. Fraud in the insurance sector is expected to rise significantly.

Hargreaves Landsdown reported that around 1 in 20 in the UK are 'are trapped in a never-ending cycle of debt.'

In this article, we aim to examine the nature of fraudulent insurance claims & application fraud and how fraud detection technology can be implemented to prevent it.

Minimising the risk of fraud in financial services is a top priority

Detecting and minimising the impact of fraud remains a top priority for the financial industry. The evolving nature of technology has made it a crime that is exceptionally difficult to contain across markets.

In order for financial companies to better equip themselves against falling victim to fraud, it is vital to understand the driving factors behind fraudulent behaviour. Intentional human action in conjunction with the digital revolution has spearheaded the ways in which fraud has evolved over the years.

More recently, the escalating cost of living crisis across the globe, propelled by one calamity after another, has created extreme economic conditions that has left a ripe digital space for fraudulent opportunists.

A recent survey conducted by Insurance Post questioned respondents from within the insurance sector on whether they believed the current economic climate would have an impact on fraud and 98.1% believed that it would.

Dispelling the myth fraud is committed solely by organised crime

It has become a widespread notion that fraudulent behaviour is limited to organised criminals. On one hand, this can be true as organised fraud remains commonplace. However, in times of economic crisis, opportunistic fraud typically occurs at the hands of the everyday law-abiding citizen. When there is a growing concern about one's own financial stability, consumer's are more likely to lie in order to access financial protection such as loans and insurance policies.

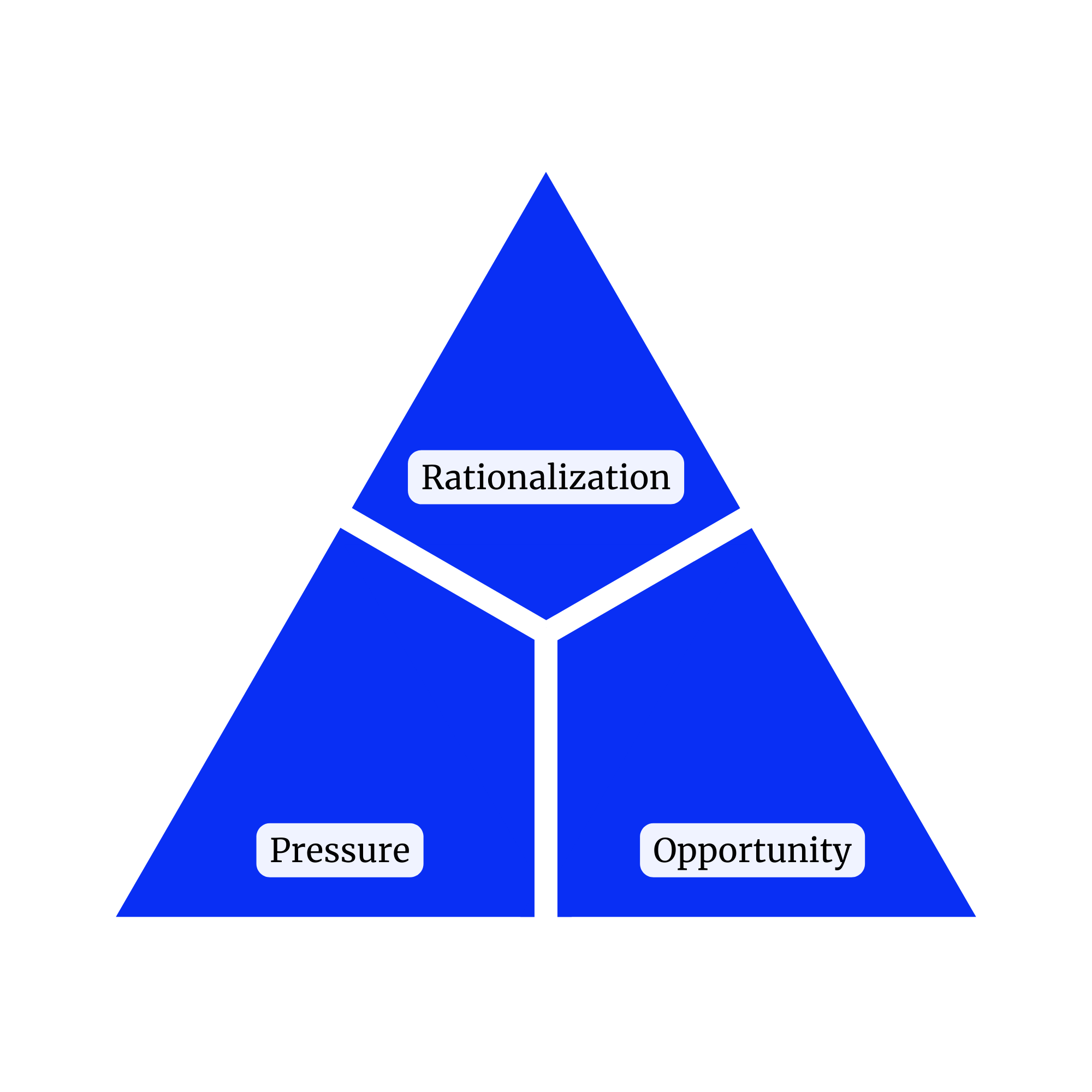

The fraud triangle is beneficial in understanding the driving factors behind opportunistic fraud, that can result in fraudulent applications for insurance or later down the line, insurance payouts, as the behaviour associated with it widely differs from that of organised fraud. Distinguishing between the two is necessary in order to develop the most effective strategies to target each type of fraudster, as well as implementing the appropriate technologies.

The fraud triangle is a framework which can be utilised in auditing that helps illustrate three key factors that may contribute to individuals committing fraud. The three components outlined include; pressure, opportunity and rationalisation.

Motive driven by pressure is typically associated with the financial constraints that people experience when confronted with personal issues such as debt. As the cost of living crisis intensifies, more and more individuals are feeling the financial burden and as a result, become more likely to risk the opportunity to commit fraud, given a low perceived risk of detection. The rationalisation element of the triangle refers to the self-justifying behaviour fraudsters engage in. Under pressure and with opportunity, fraud is easily passed off as necessary action or a ‘minor crime’.

Insurance sector worries most about rise of opportunistic and application fraud

Insurance Post's survey also posited the following question to its respondents, 'What fraud typologies are you seeing the biggest increases in currently?'

Credit: Insurance Post

As evident in the figure above based on data collected by Insurance Post, the insurance industry has had the most staggering rise in opportunistic fraud, followed by application fraud. Typically, opportunistic fraud and application fraud is committed by individuals who do not consider themselves to be criminals or engage in criminal activities, their behaviour is fraudulent nonetheless and can put lenders, landlords, banks, insurers and other businesses at significant financial risk.

Whilst consumers may fake the balance on a bank statement, or over-exaggerate an insurance claim, the costs to the business can reach tens of thousands for each application.

How can Fraud Finder help prevent insurance fraud?

Fraud Finder is the latest fraud and data tool developed by Homeppl to help flag fraudulent consumer applications whilst offering granular affordability insights on applicants.

Further data collected by Insurance Post demonstrates the point-of-quote as the area with the least successful fraud detection technologies. Similarly, new technologies have created a goldmine for fraudsters over the internet to try and bypass standard compliance and financial screening.

Homeppl’s Fraud Finder tool implements advanced technology to speed up automation processes and reduce fraud by analysing the financial documents attached to each application. Fraud Finder works at the point-of-quote to identify inaccurate insurance information, detect individuals with a history of fraud and provide robust validation checks using x-ray image tools to analyse document structure.

Intelligent document processing is essential in preventing fraud in the modern era; automating the review process flags suspicious fraud signals whilst simultaneously providing authentic customers with a faster, more effective digital experience. Many fintech risk managers are employing IDP and anti-fraud solutions to prevent the rising tide of insurance fraud in 2023. Insurers can verify data in seconds at the point of quote, rather than tedious and lengthy manual checks that could be peppered with human errors.

Data enrichment tools for the insurance sector

The addition of financial data enrichment in fraud analysis puts in place a proactive risk management function by providing a more in-depth method of analysing an applicant's true financial risk factors. How? By taking a more granular look at their financial activity and spending behaviour.

Fraud Finder is capable of extracting account holder and transactions information from any bank statement. Turning all financial documents into unified code, it then presents a useful set of data insights, such as:

Grouping multiple income sources

Income vs outcome expenses

Essential vs non essential spending

Suspicious payments & activity

ATM transactions

The increased access to more precise data in relation to insurance applications and their behavioural patterns enables insurers to analyse trends and more accurately identify anomalies or inconsistencies, resulting in a higher likelihood of detecting fraud. It also means that insurance companies can have a much better financial understanding of the risk involved with the approval of financial products at the point of quote. Not only financial insights can be derived from this data too. Looking outside of insurance at someone's lifestyle and behavioural habits, which can all be determined by their financial documents, can also help paint a picture of risk for insurers.

Insurers, as well as other financial lenders can try Fraud Finder for free on a two-week trial. Run as many authentic and/or fake documents through the tool as you like to determine fraud in real time. We also have a bank of documents for you to test should you wish.

What to read next:

Managing Risk & Fraud During An Economic Downturn

The Top Ways Mortgage Lenders Verify Bank Statements

How KYC Assessments can be enhanced with Document Verification

Understanding creditworthiness: Affordability assessment in 2023