Making compliance simple in consumer applications

Satisfy KYC compliance across markets with our comprehensive Anti-Money Laundering (AML) and Digital identity verification checks.

We’re trusted by the world's leading companies

Consumer applications for financial products are reviewed globally every year. Homeppl finds up to 10% of applications contain fraud.

Losses due to UK financial fraud in the first half of 2022. Optimise your risk decisioning with instant verification of your customers’ transactions.

Hours of manual labour relating to account opening can be automated and made far more efficient with our technology.

Compliance and AML checks across markets

Satisfy the ever-changing regulatory demands of financial services locally and internationally with our fully compliant Right-to rent, KYC and AML checks.

Conduct PEP and sanction checks utilising politically exposed, criminal sanctions and adverse media watchlists.

Optimise manual KYC/KYB processes with in-depth risk and financial assessment technology.

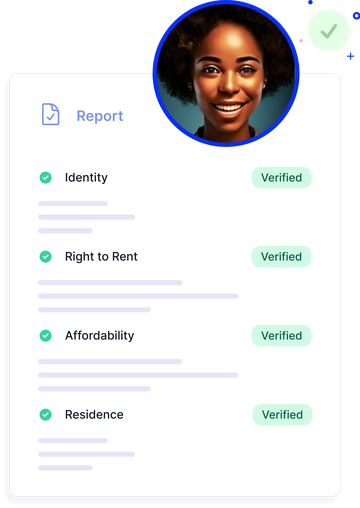

We utilise biometric recognition technology to verify identity, open accounts and authenticate ID documents.

Our most comprehensive financial risk assessment assesses financial, residential, identity, fraud, employer and criminal persona checks

risk and affordability

Compliance checks

“We’ve been most impressed with Homeppl’s ability to identify fraudsters. They have done this on numerous occasions and saved us thousands of pounds”

Kelly Fraser, Associate, Knight Frank

Sectors we serve

Protect against the growing risk of fraud in credit, business loan & vehicle finance applications.

Expand financial access to more quality customers by assessing thin-filed and international applicants.

Scale your business by enhancing efficiency with automation & customise risk appetite to suit you.

5% of properties are rented to fraudsters. Check for ID, financial and residential suitability at speed.

Talk to us about simplifying your compliance processes

We'll provide a short no-obligation demo of each element of our fraud tech, book below: